You can integrate Pleo along with other bookkeeping tools. You only need to apply for a credit line within a few minutes and start spending with the help of Divvy cards. With Business Credit, you can get access to funding of any size. The platform has some unique features that make it the right choice for every business. Divvyĭivvy is an all-in-one expense management solution for your business. Let us now look through some of the best expense tracking apps for your business.

EXPENSE TRACKING APP MANUAL

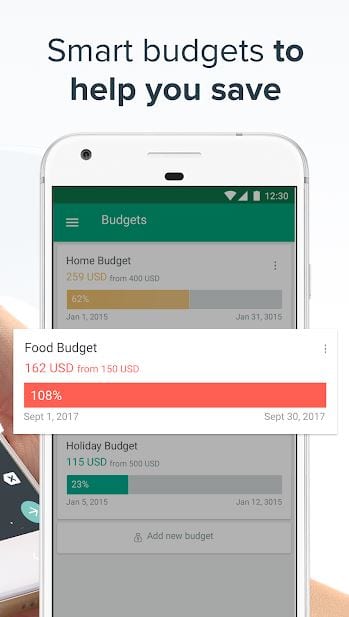

Some apps directly get linked to your bank and credit cards, saving you time by avoiding manual work. An expense tracker app helps you keep a timely and apt record of your spending by following receipts and bills. One way of tracking business expenses is by using business expense tracker apps. It will eventually help in maintaining the company budget by reflecting on expenses. Counting profits will become easy: You will be able to call out your profit numbers correctly without guesswork whenever clients ask.Your bookkeepers’ job will also be easier as it will be simple to differentiate taxable things from non-taxable ones. Some business costs are non-taxable and can be claimed as business meetings cost. Also, when you are traveling away from the city for a business meeting, you can claim a certain amount of expenses incurred. It makes you ready for tax season: You will not have to look inside your cupboard or car dashboards for bills and receipts.In that case, your assets may be at stake. If your expenses are not separate, you contradict those offerings leaving yourself accountable if a client brings in a lawsuit. It will protect you from trouble: Your business is entitled to receive legal protection that you as a person might not.Your business might be your passion, and it should be treated as such since: Also, keeping personal costs separate from business ones is necessary since a company is an independent unit. It is essential for persons owning small and medium businesses to track expenses. Why focus on Expense Tracking in Businesses? Instead, investing that money in yourself by purchasing a self-help book or enrolling in some hobby class might have been helpful. You did it just because of peer pressure. You then realized you ended up buying things you did not want. Let’s say you went shopping with your friends during the weekend. Tracking expenses will give you the freedom to put your money into productive things. Control over Finances: If you constantly in debt, it is probably because you don’t control your expenses.Spending your earnings according to the budget set by yourself comes in handy in the long run. Preventing Overspending: Expense tracking will prevent blatant overspending by forcing you to create a monthly budget.

It will further help you put your money where you need to.

0 kommentar(er)

0 kommentar(er)